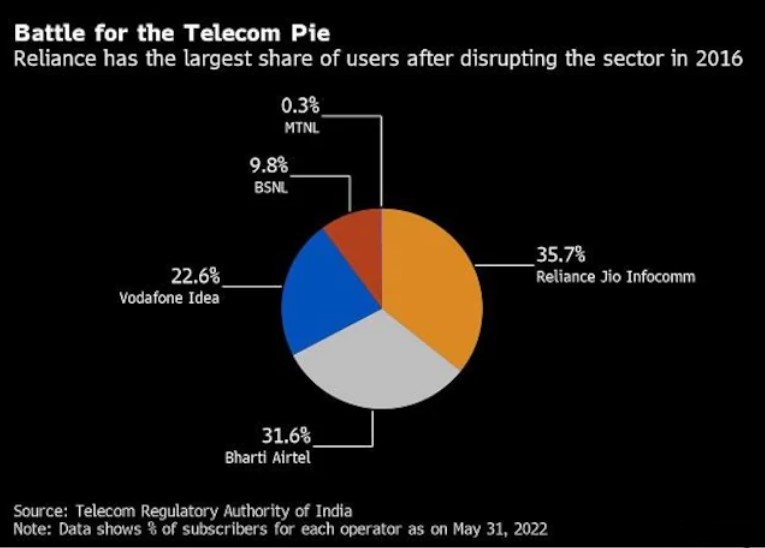

- Reliance Jio, Bharti Airtel, Vodafone Idea, and Gautam Adani companies are competing in India’s 5G auction approved by Union Cabinet on June 15.

- This auction will financially benefit the administration of PM Narendra Modi, to control inflation and reduce the fiscal deficit.

- Participants are offering up to $14 billion for the frequency rights, Ambani’s Reliance Jio Infocomm Ltd. has paid the highest pre-auction deposit.

Some of India’s richest businessmen are in the race for the fifth-generation airwaves. Billionaires like Mukesh Ambani and Gautam Adani are expected to join other players in offering up to $14 billion for the frequency rights that could help us know who will rule the digital era.

Adani Data Networks Ltd. is the surprise contestant whose bids will be closely watched as competitors. While Reliance Jio Infocomm Ltd., owned by Mukesh Ambani, has made the highest pre-auction deposit, indicating that it will likely be the most competitive bidder in the sale that begins on Tuesday. The other bidders are the wireless providers Bharti Airtel Ltd., run by billionaire Sunil Mittal, and Vodafone Idea Ltd., a partnership between Vodafone Business Plc and Kumar Mangalam Birla’s group.

The 5G auction in India has begun this Tuesday, ahead of the expected 2023 launch. Nine bands with a 20-year term are up for sale, totaling about 72,000 gigahertz. On June 15, the Union Cabinet approved the auction, enabling companies other than telecom service providers to compete for the spectrum needed to build out 5G networks. To learn everything about the auction, it is important to understand the basic terms like spectrum, 5G and its future for making digital India, expectations in the auction, and brief about the bidders. We will cover everything to help you explain why this 5G auction is a big thing.

About 5G And Its Role In Transforming India

The most recent improvement to long-term evolution (LTE) mobile broadband networks is called 5G, or fifth generation. The 5G global wireless network, according to American semiconductor and wireless technology giant Qualcomm, is expected to offer extremely low latency (the delay users experience as data travels back and forth, in other words, users will get almost no-lagging issues while using data), improved quality, more network capacity, and access.

It is estimated that 5G internet speeds will be around ten times quicker than those of 4G. Peak data transmission speeds for 5G services can reach 20 gigabytes per second (GBPS), and average speeds of more than 100 megabytes per second (MBPS). It operates in three frequency bands: low, mid, and high.

The low spectrum is appropriate for serving thousands of consumers over great distances with fewer towers and has a maximum speed of 100 MBPS. In terms of coverage, internet speed, and data sharing, it has demonstrated remarkable promise. The low band spectrum may not be ideal for the specialized needs of the business, even though telcos can use and install it for commercial mobile users who do not have particular needs for very high-speed internet.

The mid-band spectrum, which has frequencies between one and six GHz (1800, 2100, and 2300 MHz), offers coverage and can transmit more data over longer distances. The high bands, or millimeter wave spectrum, have a frequency range of 24 to 40 GHz. According to research in Moneycontrol, they are perfect for quick networks over short distances, but this range is susceptible to interference from dense objects.

The government claims that the implementation of cutting-edge use-cases and technologies would result in the creation of new-age firms, increased revenue for businesses, and employment opportunities. Fast download rates made possible by 5G will support emerging technologies like virtual reality and driverless cars.

In a recent report by Ericsson, one of the top manufacturers of 5G equipment in the US, “5G is projected to account for almost 40% of mobile subscriptions – 500 million – by the end of 2027” in India, according to CNBC.

Spectrum And Its Use In Telecom

The term “spectrum” describes the invisible radio frequencies that are capable of transmitting wireless data for a variety of services, including telephony. We can use our mobile devices to make calls, order food at the doorstep, use social media, and use apps to book cabs, all thanks to wireless signals.

Government agencies allot airwaves to businesses or industries for use. Bands are used to further divide spectral ranges, ranging from low to high frequency. Low-frequency waves provide a larger coverage area whereas high-frequency waves are faster and can carry more data.

According to the GSM Association, a group that advocates for mobile network carriers, spectrum in the 400 MHz to 4 GHz band are the best for telecommunications. If operators have access to the proper spectrum, they can offer 2G, 3G, 4G, and 5G services using a single frequency band.

What This Auction Is Going To Bring?

Reliance Jio, Bharti Airtel, Vodafone Idea, and Adani Data Networks, a division of the Adani Group, are the four companies taking part in the auction. They have provided the Department of Telecommunications (DoT) with Earnest Money Deposits (EMDs), a major indicator of their reason to bid. As per a report by The Indian Express, Reliance Jio has invested Rs 14,000 crore compared to Rs 5,500 crore from Bharti Airtel, and Rs 2,200 crore from Vodafone Idea, and Rs 100 crore from the Adani Group. EMD reflects the number of airwaves that a corporation may bid for in the auction.

The telecom department estimates that the 5G auction will bring in anywhere from 70,000 to 1 billion rupees. Analysts predict that Jio will spend the most money, followed by Bharti Airtel and Vodafone Idea, with minimal contributions from the Adani Group. A competitive bidding war is unlikely because there is excess spectrum available and only four bidders are competing.

“Operators will bid for 5G networks, reducing SUC (Spectrum Usage Charges) rates and enhancing existing spectrum bands, resulting in demand mainly led by 3.3 GHz/26GHz spectrum bands,” said brokerage firm Jefferies.

Jio is likely to submit a proposal for the 700 MHz band, which is suitable for applications linked to consumers and has the potential to purchase spectrum for Rs 1,30,000 crore.

The Adani Group has previously made it clear that it is taking part in the auction to create standalone private networks and is not targeting the 5G market. According to a study from Credit Suisse, Adani’s low EMD in comparison to the competition “does indicate that its participation in the spectrum auction will largely be limited to the 26GHz band,” which is the “cheapest band for enterprise use cases.”

According to Credit Suisse, Airtel would likely limit its bids to the 3.5 GHz and 26 GHz bands. According to the article, Vodafone Idea “will be able to bid for the minimum required spectrum: around 50MHz in 3.5GHz band and 400MHz in 26GHz bands.”

Ambani Vs. Adani

The Adani empire, which earlier this year beat Ambani as Asia’s richest man, is making its entry into a brand-new field for the group. It claimed that it has no plans to compete in the Ambani-dominated consumer mobile market and that its interest in 5G waves is focused on “private network solutions” and improving cybersecurity at the company’s ports and airports.

However, the news comes as the two businessmen increasingly walk similar sectors, with Adani especially making investments in fields typically linked to Ambani, who revolutionized the Indian telecommunications sector with Reliance Jio’s cheapest services almost six years ago.

But when Adani Data paid only 1 billion rupees as a deposit for the auction, expectations that 5G was going to become a conflict between Ambani and Adani were somewhat calmed. Brokerages frequently see the payment as a crucial sign of the level of interest shown by a bidder.

India Trying To Catch Up With South Korea and China’s Technology

India is at a very important stage in its digital development, with many businesses competing for a piece of the intersection between mobile and the emerging e-commerce market, including multinationals like Walmart Inc. and Amazon.com Inc.

Adani Data’s modest contribution, which was by its declaration that it would only build a private 5G network and not turn into a full-fledged wireless operator, helped ease the concern of established companies in the sector. According to data released by the government, Reliance Jio deposited 140 billion rupees, which is significantly more than Bharti Airtel’s 55 billion rupees and Vodafone Idea’s 22 billion rupees.

“Whether it is Adani or Ambani, India will benefit from a massive 5G roll out,” said Utkarsh Sinha, Managing Director, Bexley Advisors, a boutique investment banking firm. “Adani’s entrance has shaken up entrenched Reliance Jio and the massive earnest money commitment shows that they see the 5G value proposition and can’t afford to lose out on it.”

The government of Prime Minister Narendra Modi, which is trying to control inflation and reduce the fiscal deficit, will benefit financially from the auctions. For 20 years, the South Asian country intends to sell 72 gigahertz of airwaves in a variety of frequency bands, from 600 megahertz to 26 gigahertz. In an effort to catch up to nations like South Korea and China that have had 5G networks for years, India has also let businesses pay in 20 equally spaced installments with no initial cost.

The attempt of India to walk on the road of digital development has been constant and we can believe that this 5G auction can do wonders for the digital dream of our country.